No-Fault vs At-Fault Auto Insurance, Which Saves You More?

Auto insurance rules shift from state to state, and one of the biggest dividing lines is how a state assigns responsibility after a crash. Some states follow at-fault rules, where the person who caused the wreck is responsible for losses. Others use no-fault rules, where medical costs are handled by each driver’s own policy regardless of who triggered the collision. These systems influence what drivers pay, how claims unfold, and what protections a policy must include.

This guide breaks down how each structure functions, lists the states in each category, and highlights how these systems affect premiums, claims, and coverage decisions.

How At-Fault States Handle Accidents

Instagram | @EyeEm | Drivers in at-fault states carry coverage that protects against costly accident claims.

At-fault (tort) states hold the responsible driver financially accountable for bodily injuries and property damage. Liability insurance steps in to pay the other party’s medical bills, lost income, and repairs.

Because compensation depends on proving who caused the crash, evidence like police reports, witness statements, and photographs often becomes part of the process. Disagreements about responsibility can lead to lawsuits, which is why litigation is more common in these states.

Rates in at-fault states often differ based on:

1. How frequently the drivers are found responsible for crashes

2. The size of payouts tied to injuries and property losses

3. The likelihood of lawsuits seeking compensation for pain and suffering

How No-Fault States Handle Accidents

No-fault states shift initial medical and income-loss coverage to each driver’s own policy through personal injury protection (PIP). This applies regardless of who caused the crash. The system is designed to speed up medical payments and reduce legal battles for minor injuries.

However, no-fault rules usually limit when an injured party can sue for non-economic damages. In many states, a “serious injury” threshold must be met before a lawsuit for pain and suffering can move forward.

Property damage claims, including vehicle repairs, still rely on determining fault, but the approach to bodily injury claims is what sets these states apart.

States That Use Each System

No-Fault States:

Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

At-Fault States:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Louisiana, Maine, Maryland, Missouri, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

While the majority of states follow at-fault rules, no-fault states maintain unique systems designed to streamline medical claims and reduce litigation.

How Fault Impacts Premiums and Claims

The structure a state uses can reshape both premiums and claim behavior.

In no-fault states:

PIP adds required medical coverage to each policy, which can increase base rates. Lawsuit thresholds may lower legal exposure for small claims, but higher coverage requirements can raise overall costs.

Some drivers still experience rate changes even if they weren’t responsible for the accident, since claims draw from their own policy.

In at-fault states:

Liability limits matter because lawsuits can involve medical bills, vehicle repairs, and non-economic damages. A driver found responsible for a crash can face sharper premium increases. Accident history often plays a major role in rate adjustments.

Additional factors:

Freepik | senivpetro | Drivers should understand insurance laws to choose the right coverage confidently.

1. Moving between systems (for example, relocating from a no-fault to an at-fault state) often changes required coverages and overall pricing.

2. A widely cited historical comparison found that no-fault states had premiums about 19% higher than tort states on average.

3. No-fault systems can lead to more complex medical coverage structures, while at-fault states may increase exposure to lawsuits.

What Drivers Should Keep in Mind

The rules in a state directly shape how coverage is designed and how claims unfold.

1. State requirements – No-fault states mandate PIP, while at-fault states focus on liability protection.

2. Limits on legal action – No-fault thresholds can restrict lawsuits for pain and suffering unless injuries reach a legally defined severity.

3. Claim history – Fault-based crashes in at-fault states can lead to significant premium spikes. In no-fault states, medical claims may influence rates even without fault.

4. Policy design – Coverage must align with how the state handles bodily injury and property damage.

5. Relocation – Changing states may require adjusting limits, adding PIP, or modifying coverage levels to meet new rules.

Whether a driver lives in a no-fault system or an at-fault system, the state’s legal structure shapes coverage needs, claim procedures, and long-term costs. Knowing how each framework works helps drivers choose appropriate limits, understand how claims may unfold, and anticipate how an accident could affect future premiums.

More inCar Insurance

-

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025 -

`

U.S. Reduces Tariffs on Japanese Cars to 15% Under Trump’s Deal

In a move reshaping U.S.-Japan trade relations, former President Donald Trump confirmed a new agreement that slashes tariffs on Japanese car...

August 9, 2025 -

`

Adults in Ohio Face Stricter Rules to Obtain Driver’s License

Ohio has passed a new law that will change the way adults under 21 get their driver’s licenses. Signed into law...

July 31, 2025 -

`

Gen Z Craves Career Guidance, But Their Parents Are Struggling Too

Gen Z is stepping into the future with curiosity and ambition—but they’re not doing it alone. A growing number of teens...

July 25, 2025 -

`

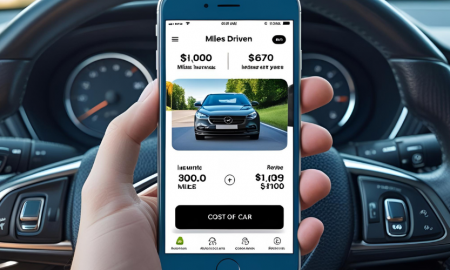

Do Car Insurance Companies Offer Pay-As-You-Go Plans?

Car insurance premiums often feel unfair to people who rarely drive. Yet, most traditional auto policies still charge a fixed monthly...

July 17, 2025 -

`

Why the Koenigsegg Sadair Spear Is the Ultimate Hypercar Beast

Koenigsegg has revealed a new beast—the Sadair’s Spear. Tuning its focus on raw performance and brutal speed, this hypercar marks the...

July 11, 2025

You must be logged in to post a comment Login