U.S. Reduces Tariffs on Japanese Cars to 15% Under Trump’s Deal

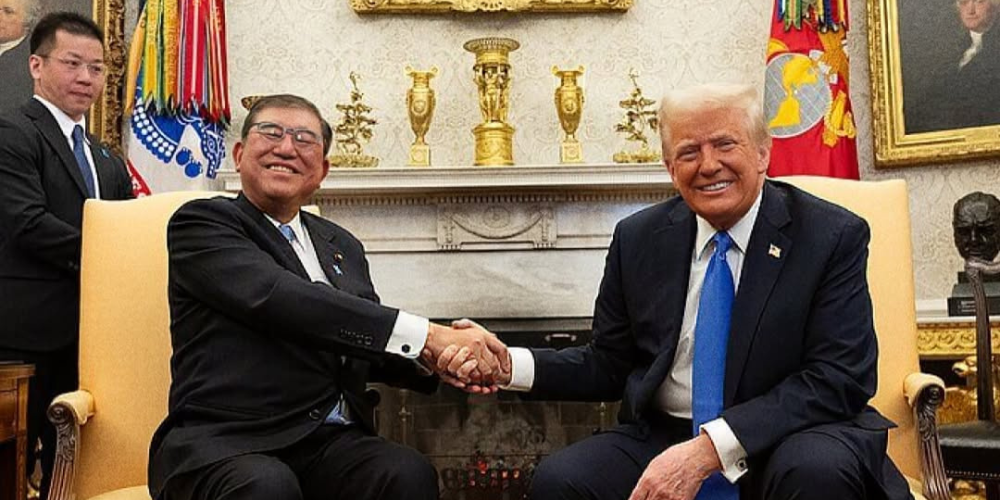

In a move reshaping U.S.-Japan trade relations, former President Donald Trump confirmed a new agreement that slashes tariffs on Japanese car imports to 15%. The announcement, made on social media, followed months of mounting pressure and negotiation.

Previously, the administration threatened a steep 25% tariff on Japanese vehicles if a deal wasn’t reached before August 1. Instead, this agreement not only eased that threat but also brought new developments for both American and Japanese automakers.

Key Terms of the Deal

Instagram | newsofbahrain_ | Trump confirmed 15% tariffs on Japanese cars after negotiations.

The trade pact includes several headline-making points:

1. Japanese car exports to the U.S. now face a 15% tariff, reduced from the proposed 25%.

2. Japan will open its ports to more American vehicles, including trucks.

3. The deal includes additional agricultural exports from the U.S., such as rice.

4. Japan will invest $550 billion into the United States as part of the agreement.

These provisions mark a significant shift in how the two nations manage automotive trade. The U.S. auto industry, already strained by global tariffs, saw this as a critical update.

How the Tariff Breakdown Works

Although the 15% tariff seems straightforward, it actually includes layered components. According to Japan’s NHK broadcaster, the administration agreed to reduce the auto-specific tariff from 25% to 12.5%. Combined with the existing 2.5% import duty, the final rate now stands at 15%. That still represents a major drop from what could’ve been a damaging 25% charge.

According to The New York Times, Shigeru Ishiba, Japan’s Prime Minister at the time, acknowledged the update and awaited further clarification from diplomats based in Washington.

Impact on Japanese Automakers and Market Response

Japan’s automotive sector quickly responded to the announcement. The trade deal comes as a relief, particularly given the country’s heavy reliance on vehicle exports to the U.S. Major Japanese auto brands experienced an immediate surge in investor confidence:

Toyota shares rose by 14%

Nissan climbed by 8%

Honda jumped 11%

Analysts pointed out that reduced tariffs mean stronger competitiveness for Japanese models in the American market. Vehicles that previously faced higher import duties can now sell at lower prices or bring greater profit margins.

Concerns From U.S. Industry Leaders

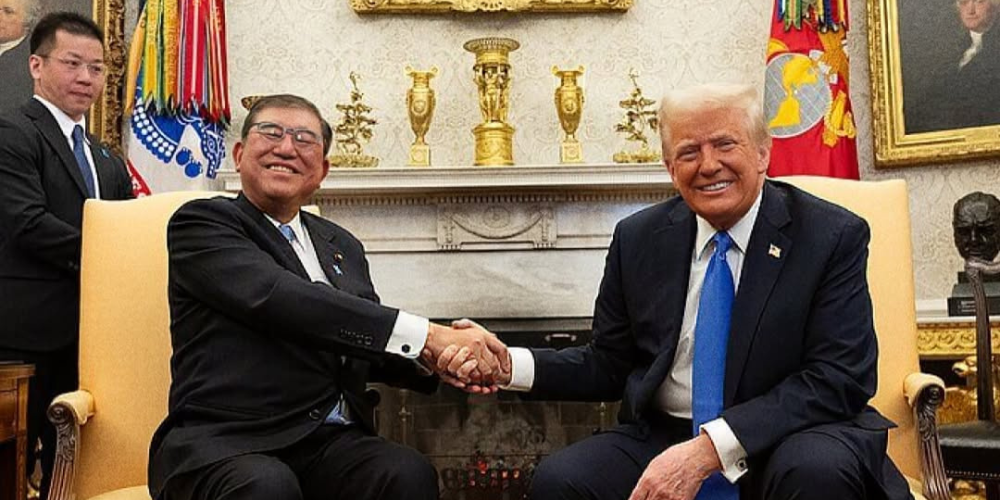

Instagram | @revistapluspy | American car makers are frustrated, as the Japan deal disadvantages their North American vehicles.

While the deal appears favorable for Japanese automakers, it has stirred unease among American car companies. The American Automotive Policy Council—representing Ford, General Motors, and Stellantis—argues that the agreement tilts the playing field against North American manufacturers.

Their concern centers on the fact that many Japanese imports contain only a small fraction of U.S.-made components, yet they will now be subject to a lower tariff than cars assembled in North America with a far higher share of domestic parts. Council President Matt Blunt called it a direct blow to American industry, saying such deals “undercut American workers and businesses.”

Union leaders and trade advocates share this view, seeing it as yet another example of policy that rewards foreign assembly over homegrown production.

A New Chapter in U.S.-Japan Automotive Trade

For consumers, reduced tariffs could mean Japanese cars hitting U.S. showrooms at more competitive prices—possibly making models like the Toyota Corolla Hybrid or Honda CR-V even more appealing to budget-conscious buyers. Yet this affordability comes with a flip side: American automakers may be pushed to trim costs, rethink supply chains, or double down on unique selling points such as advanced EV technology, luxury features, or niche performance models.

In the bigger picture, the agreement is part of a broader U.S.-Japan effort to cement economic ties in the face of shifting global trade dynamics, where tariffs are as much a diplomatic tool as they are an economic one. Trump’s administration repeatedly leaned on tariffs as negotiation tools — this deal proves that pressure can yield strategic outcomes when used deliberately.

Lower tariffs often open doors. With this agreement, Japan gains room to grow in the American market, while U.S. manufacturers must now rethink their strategy. Trade talks like these remind global players that economic influence doesn’t only come from products—it also comes from policy.

More inAuto News

-

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025 -

`

Adults in Ohio Face Stricter Rules to Obtain Driver’s License

Ohio has passed a new law that will change the way adults under 21 get their driver’s licenses. Signed into law...

July 31, 2025

You must be logged in to post a comment Login